服务

联系人

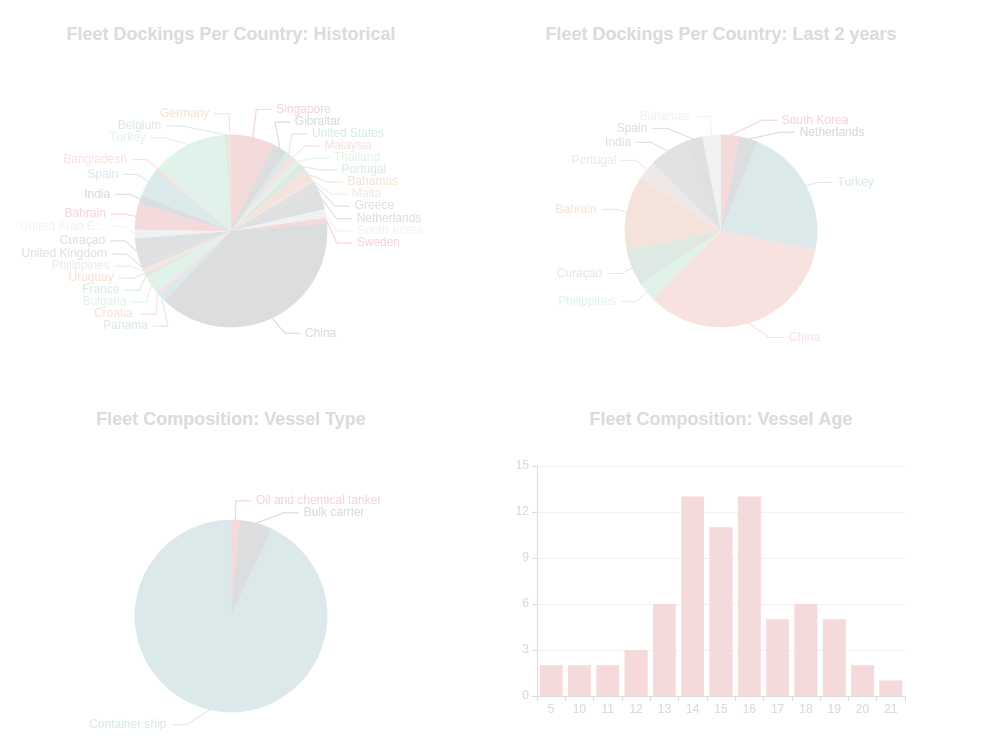

船舶数据

New Ships

目前共有 8 条船只订单.

Please Visit new-ships.trusteddocks.com for the full information about the new-build market.

规程

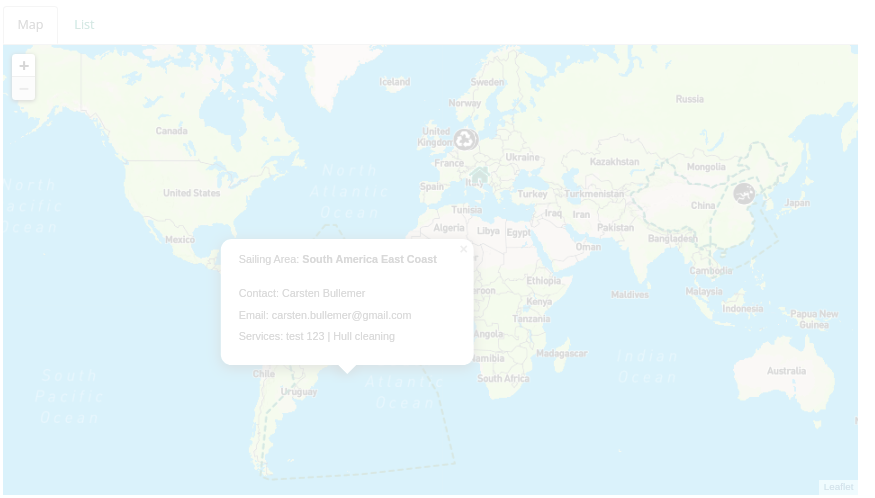

地区服务

照片库

视频

宣传材料

相关新闻

Gearbulk Enhances Fleet Sustainability with Order for Two Additional Pulpmax Sister Vessels

https://tdl.ink/p/789发布人 Raghib (5 months ago)

Image credit: Gearbulk.

Gearbulk has finalized agreements for the construction of two additional Open Hatch newbuildings, each with a capacity of 82,300 deadweight tons (dwt), designed to be ammonia/methanol conversion-ready. These vessesl, set to complement the Pulpmax series (units1-4), are to be constructed at CSSC Huangpu Wenchong Longxue Shipyard in Guangzhou, China.The anticipated delivery dates are October 2028 and January 2029.

Consistent with the Pulpmax series, these sister ships will feature advanced technical specifications, including eight holds and hatches, as well as four electro-hydraulic jib cranes. Of these cranes, two have a Safe Working Load (SWL) of 75 metric tonnes each, while the remaining two offer an SWL of 120 metric tonnes each. The vessels will also be equipped with tween decks and boast an overall length of 225 meters and a beam of 36 meters.In alignment with future-proofing strategies, dedicated deck space on either side of the accommodation block has been allocated for the installation of alternative fuel tanks. These specifications underscore Gearbulk’s commitment to innovation, particularly in its pursuit of cleaner maritime fuels and sustainability.

Trafigura Completes Gearbulk Stake Acquisition and Commissions New High Heat Tanker

https://tdl.ink/p/751发布人 Raghib (5 months ago)

On 22 July, the Trafigura Group has successfully acquired Gearbulk Holding AG’s 50 percent share in the joint venture company High Heat Tankers Pte Ltd (HHT) for an undisclosed amount. Additionally, the Group has committed to commissioning a new 17,500 dwt IMO II specialized high heat tanker, slated for delivery in the third quarter of 2026 from Chengxi Shipyard, China. This strategic acquisition and expansion are poised to significantly enhance HHT’s service capabilities.

The forthcoming vessel will be equipped with a high-efficiency heating system, specifically designed to transport products in liquid form at elevated temperatures. The design incorporates strongly insulated and fully segregated ‘floating’ cargo tanks, allowing for thermal expansion without contact with the hull’s inner side. This innovative design, combined with thick insulation of the cargo tanks, will considerably reduce the energy required for heating.High Heat Tankers Pte Ltd was established in 2018 as a joint venture between Gearbulk and Trafigura Group’s Puma Energy Supply and Trading Pte. Ltd.

The venture provides access to the world’s largest fleet of modern IMO II high heat tankers. Presently, the HHT pool consists of 14 high-quality tankers, ranging from 15,000 to 37,000 dwt, capable of transporting liquid pitch and other high-temperature products such as bitumen. This strategic acquisition and fleet expansion underscore Trafigura Group’s commitment to enhancing its capabilities in the specialized transport of high-heat products, further solidifying its position in the global maritime industry.

Japan’s MOL Expands Holdings with Gearbulk Takeover

https://tdl.ink/p/697发布人 Raghib (6 months ago)

https://splash247.com/mol-takes-over-gearbulk-from-kristian-jebsen/

Mitsui OSK Lines (MOL), Japan’s largest shipowner, is poised to take over Gearbulk from Kristian Jebsen in a significant acquisition expected to conclude by January next year.MOL first invested in Gearbulk, the world's largest open-hatch operator, in 1991 by acquiring a 40% stake in the company, which was established in 1968. Over the years, MOL increased its shareholding to 49%, while Jebsen retained the 51% majority stake. Today, MOL announced its plans to further expand its investment, with the company set to hold a 72% stake in Gearbulk by early 2025.

Gearbulk boasts a fleet of 60 vessels, along with several ships currently on order in China. The financial details of this takeover have not been disclosed.This acquisition is part of MOL’s broader strategy of investing in Norwegian maritime assets. In recent years, MOL has acquired stakes in several Norwegian companies, including Odfjell Oceanwind, Larvik Shipping, and AKOFS Offshore. This trend underscores MOL’s commitment to expanding its global footprint and diversifying its portfolio within the maritime industry. MOL's move to increase its stake in Gearbulk reflects the company’s confidence in the growth potential of the open-hatch sector and its strategic importance in the global shipping market.